--------------------------------------------Chad Borseth-------------------------------------------------------

1.) According to the South Washington County District 833 website the district

has 18,700 students with a budget of $260 million a year. The school district

website says they get $13,800 per student. In a class of 30 students that's

$414,000 per class. To the average voter it seems to be more than enough to run a

school. Yet the district says it is under funded by at least $500 per student. Do

you think the budget can be spent more wisely? If so, what is your biggest way to

specifically save money?

I haven’t yet had the chance to review the full financial documents in detail, but if the

numbers you cite are correct, they are concerning. It’s a reasonable question that any

current board member, with direct access to financial staff and documents—should be

able to explain clearly to stakeholders. Two specific approaches I would pursue are:

1. School-Based Cost Savings Plans: Require each principal to create and present

a cost-savings plan for their building that meets predetermined goals set by

district leadership. Departmental cost-saving targets are common in other

sectors, and there’s no reason our district leaders cannot do the same.

2. Leveraging Indirect Staff: Utilize the talents and teaching licensure of indirect

building and district staff to help address substitute shortages and support

instruction. Beyond saving money, this places staff closer to students, parents,

and teachers—giving them valuable firsthand experience they can bring back to

their regular roles to better serve the district.

2.) The school district website said that it lost 500 students. This loss seems to be

to private and charter schools. This seems fair considering the low achievement

scores. Such as only 53% of 3rd graders were proficient in reading and math.

What is your biggest way to improve scores in a specific way?

I strongly support school choice for families. Our community is fortunate to have

excellent public, private, and parochial schools, as well as two local public charters

ranked among the top five in Minnesota by U.S. News and World Report. My wife and I

chose this community eleven years ago because of diversity of school offerings, and we

were literally draw to an 833 district magnet school, Nuevas Fronteras. My priority will

always be strengthening our district schools, but I also want to build stronger

relationships with charter and private schools—learning from what they are doing well.

Specifically, I want to know how these schools are achieving both high academic results

and strong student engagement that leads to excellent attendance. Most importantly, we

need our community, staff, and leaders to once again value test scores. Too often

they’ve been delegitimized, and when that happens, it’s reasonable that students

themselves will not take them seriously. Raising expectations and restoring the value of

test scores is a key step toward improving results in our district.

3.) What are your top priorities and how would you specifically address each?

1. School safety has become an urgent concern in the wake of the recent tragedy

in Minneapolis. No family should worry whether their child will return home safely

from school. In 2023, our community approved funding for significant school

security upgrades; however, we can’t stop prioritizing school safety. We must

strengthen partnerships with local law enforcement to ensure school staff are

prepared to respond to emergencies.

2. Address Chronic Absenteeism - A thriving school district depends on students

being present and engaged in the classroom. Yet our attendance data tells a

troubling story. In the 2022–23 school year, chronic absenteeism rates were 20%

at East Ridge High School, 27.4% at Woodbury High School, and 36.1% at Park

High School. District-wide, the rate was 25.5% (Minnesota Department of

Education, n.d.). This problem is not new—it has persisted across several school

board election cycles. These numbers are unacceptable.

We must act with urgency to improve attendance and ensure that students are in

school, learning every day. Improving attendance starts with consistent best

practices at the school level. Policy should clearly dictate when attendance is

taken during class, and it must define the difference between “tardies” and

“absences.” Minnesota law requires students to attend school, and our schools

need to follow proper protocols for escalating truancy cases. At the same time,

the county must provide the support that schools and families need when truancy

issues arise.

3. Align School Board Races with General Elections for Higher Turnout and

Lower Costs - South Washington County School District remains one of the few

in Minnesota holding school board elections in odd-numbered years. This

off-cycle timing severely suppresses voter turnout—national studies show turnout

in off-cycle local elections can be up to half that of on-cycle elections held

alongside major contests.

In contrast, the vast majority of Minnesota districts have shifted to on-cycle

elections during even-numbered years, aligning with general elections to boost

participation and reduce administrative costs. By moving our elections on-cycle,

we can increase community engagement and ensure our school board truly

reflects the broader community—not just a narrow slice of voters or influential

special interest groups.

Financially, the cost for our district to maintain off-cycle elections is striking. For

example, in Edina, conducting off-cycle elections cost taxpayers upwards of

$150,000, whereas on-cycle elections (even years) are much less because they

happen alongside regular elections (Albertson-Grove, 2023). More recently, the

Wayzata school board voted to move to on-cycle elections starting in 2028

(Wayzata Public Schools Board, 2025), and is estimated to save roughly

$100,000 per election by making this change.

As a school board member, I will advocate to align our elections with even-year

cycles—joining the more than 90% of Minnesota school districts that have

already made the switch. Doing so would strengthen democratic participation,

reduce the influence of massive special interest group spending in our school

board races, eliminate wasteful spending, and enhance the legitimacy of our

governance.

Thank you for reaching out with your questions. I appreciate the opportunity to provide direct answers. Budget and Spending

Yes, I believe the budget can be spent more wisely. A specific area for savings is administrative overhead. By streamlining central office operations and reducing duplication in non-classroom functions, more dollars can reach classrooms directly where they have the greatest impact.

2.) Focus on reading and math fundamentals through proven instructional methods.

3.) Fiscal Responsibility: Direct more dollars into classrooms by reducing administrative costs.

Parental Involvement: Strengthen communication and partnerships with parents, since engaged families improve student success.

I believe these priorities, addressed with discipline and transparency, will help restore trust and improve outcomes for our students.

Thank you again for the opportunity to respond.

Best regards,

Travis Allen Dahle

-----------------------------------------------------------------------------------------------------------------------

As a board member, my highest priorities for South Washington County Schools’ budget include initiatives that positively impact students. Students' needs are best met by paying teachers, paraprofessionals, bus drivers, mental health support staff, nutrition staff, and more. The staff in this district shape student experiences at school and build their community - they’re critical. We must use the budget to value staff with competitive rates so we retain their expertise and commitment to our community.

I have attended many board meetings and listened to Director of Business Services, Kris Blackburn, discuss the district financial position. Given the inflationary environment (which will impact costs of everything from food to energy in our schools) and the instability with the state and federal budgets for education, the district has built up an adequate fund balance to bring some stability despite current challenges.

Nationwide standardized test scores have been trending downward for a decade or more. Students are more likely than ever to spend time on screens leading to an age of instant gratification and many read less often. I share concerns about declining reading scores.

Specific steps SoWashCo schools are taking to address these concerns include developing cell phone policies in accordance with new state mandates - banning cell phones in middle schools and restricting them in the high schools. This is a promising start for students. Depending on the data from this policy change, that could be taken further at the high school level as well. Secondly, the READ Act training provided for all staff in the district during the 2024-25 school year should be leveraged. We need our teaching experts and staff to utilize these skills with students to continue to improve literacy. We may need to crowdsource some innovative ideas around literacy challenges, activities and ways that all staff can interact with students intentionally to work on improving literacy.

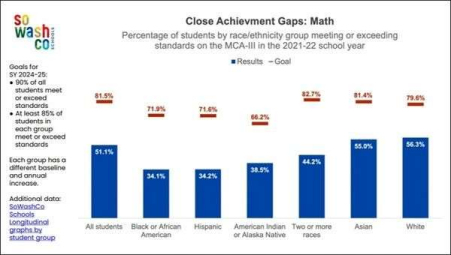

Achievement Gap: The academic achievement gap in South Washington County demands our focus and persistence. My goal is to continue the long-term work of reducing the academic and opportunity gap for at-risk and students of color. We can even look to our students to partner with us and set amazing examples: ERHS Students Work to Close the Gap.

Teacher Retention: High quality teachers and teacher retention improve student outcomes and help close achievement gaps. We want to retain these talented professionals for our students. As a board member, I will strongly advocate for organized labor and positive labor relations with district unionized staff. I am committed to ensuring fair wages and working conditions. I will embrace a strong partnership, constructive negotiations, and mutually beneficial solutions. We must continue to value the individuals committed to supporting and educating our students.

Diverse Hiring Practices: The district must continue to invest in diverse hiring practices. It is critical that students see themselves reflected in and can connect with their teachers and school staff - currently in MN only ~5% of teachers identify as non-white.. I would advocate for unconscious bias training in hiring committees, diverse hiring committees, community partnerships, objective screening practices, and tracking metrics to ensure the district is meeting goals.